Match Group Inc. gave an upbeat revenue forecast for the current period, but the shares fell on investor concerns the momentum generated by the company’s dating apps may be stalled by the spreading COVID-19 delta variant.

Third-quarter revenue will be US$790 million to US$805 million, the Dallas-based company said Tuesday in a statement. Analysts, on average, estimated US$769.1 million, according to data compiled by Bloomberg. Match forecast adjusted earnings before interest, taxes, depreciation and amortization of US$275 million to US$280 million. Analysts projected about US$285 million, according to data compiled by Bloomberg.

Despite the optimistic forecast, the shares declined about 4.3 per cent at 9:46 a.m. Wednesday. The stock has declined about one per cent this year.

Chief Executive Officer Shar Dubey hinted the company isn’t in the clear from COVID-19 as key markets including India, South Korea, Brazil and Japan are further behind in recovering from the pandemic.

Match “is showing clear signs of strength, with more room to run as additional markets come up the vaccination curve,” Dubey said in a letter to shareholders accompanying the results. “While COVID continues to create uncertainty and the variants are increasingly a concern, our business has proven to be quite resilient.”

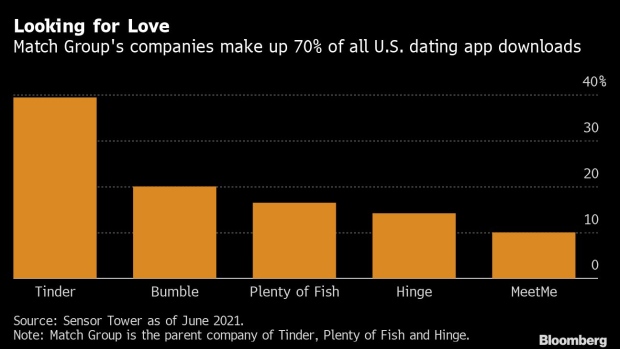

Match owns some of the world’s most popular dating products including Tinder, Hinge and OkCupid. The COVID-19 pandemic has forced dating apps to adapt their platforms to make virtual courting more engaging with features like video and speed-dating games. Even so, digital dating isn’t a replacement for human connection. Increased vaccinations and improving COVID-19 conditions in some parts of the world boosted the number of Match users who pay for additional features that get them one step closer to love.

The pandemic also spurred Match to think beyond romantic relationships and expand into platonic friendships with its acquisition of South Korean video technology company Hyperconnect. The dating app giant is hoping to capitalize on the rise of the “social discovery” space that is being fueled by a growing base of young users who have a higher propensity to seek out friends online.

Revenue rose 27 per cent to US$707.8 million in the three months ended June 30, surpassing the average analyst estimate of about US$692 million. The company reported earnings of 46 cents a share.

“The dynamics of a reopening should ultimately be a net benefit for Match, but we see some uncertainty at least in the short term from potential current and future impacts from the delta variant which could slow engagement,” Wedbush Securities Inc. analyst Ygal Arounian wrote in a note.

Match’s star performer Tinder generated a 26 per cent increase in direct revenue from the same period a year earlier. Paying users for all of Match’s brands grew 15 per cent to 15 million with gains across North America and other international markets.

Match falls as COVID-19 concerns cloud positive forecast - BNN

Read More

No comments:

Post a Comment